The 5 Best Kid Budgeting Apps in 2024

With so many apps and tools out there designed to help kids learn about the value of money, it can be overwhelming to know which one to choose. There are a lot of factors to consider such as ages of your children, price, and specific goals. No matter your situation, I think you should be able to find one that is right for your family on this list of the 5 best kid budgeting apps in 2024:

1. Greenlight

This highly rated family money management app is a great tool to help kids and teens save money, set savings goals, track their spending, and improve financial literacy. This app even allows kids to invest if you opt for one of the higher-tiered plans.

It comes with a prepaid debit card for up to 5 children. Kids can use the card to make purchases or withdraw their own money from an ATM. Real-time notifications are provided and the app has plenty of parental controls to set spending limits and track purchases to ensure your kids are developing responsible spending habits.

Parents can send money to their kids or pay an automated allowance. Direct deposit can also be set up on the card if your teen has a part-time job. To incentivize your child to save more money, parents are able to offer savings rewards and set custom interest rates for their child’s savings to mimick a bank account.

In addition to parent-funded incentives, kids earn between 2-5% interest from Greenlight on their savings up to a balance of $5,000. They also get 1% cash back every time the debit card is used which goes directly into their savings account These unique features that are not offered by any of the other apps in this article.

Cost

Greenlight has 3 different plans to choose from (Core, Max, and Infinity) which range from $5.99/month to $14.98/month. You can sign up for a 1 month free trial to get started.

2. GoHenry by Acorns

This is another highly rated money app designed to teach kids responsible financial management. It’s goal is to help kids save money, track spending, invest, and understand financial concepts. It is ideal for those between the ages 6 to 18.

Like Greenlight, parents are able to monitor purchases and set spending limits. And while they cannot set custom interest rates or offer savings reward, they are able to incentivize different chores and tasks that your child can complete to earn extra money.

This is one of the best budgeting apps for kids because of the investing feature which is integrated with Acorns. It allows kids to make real-life investments with the permission and oversight of a parent. This is the best way to learn the power of compound interest from an early age.

Cost

GoHenry offers a 1 month free trial and then costs $4.99/month for one child. Or you can pay for a family plan which is $9.98/month and includes up to 4 children.

3. iAllowance

The primary focus of iAllowance is to help kids understand the value of money and encourage savings habits. Kids are able to virtually track their allowance, manage chores, and set savings goals.

This app enables kids to set up an unlimited number of “banks”. These banks are essentially digital envelopes for different spending categories or financial goals. This is an effective way to teach kids how to allocate money toward specific purposes and future expenses.

While the app doesn’t provide interest on savings like Greenlight, parents can choose to provide a custom interest rate (parent-funded) for each bank if desired. It also offers a gamified experience with badges and rewards which is great for motivation.

iAllowance does not include a debit card which makes it better suited for younger kids or those who are not quite ready for a debit. It also doesn’t include any specific financial lessons and there aren’t any options for investing.

Cost

iAllowance has a one-time purchase fee of $2.99 which includes an unlimited number of children.

4. BusyKid

The BusyKid app is a great choice for parents who want a straight-forward, chore-based allowance app that includes useful features such as saving, spending, and basic investing. It has tools for teaching kids financial responsibility and offers a simpler, more streamlined interface than Greenlight or GoHenry.

A unique feature is the “Give” option which allows kids to donate a portion of their money to selected charities. This may be valuable to families who want to emphasize charitable giving as part of their children’s financial education.

Cost

BusyKid provides debit cards for up to 5 family members with a monthly subscription fee of only $4.99/month.

5. Bomad Allowance Tracker

If you are looking for an app that is free, Bomad (Bank of Mom and Dad) might be right for you. It is ideal for parents who want a simple and easy to use tool to manage allowances, chores, and basic savings for younger children. The free version lacks most of the advanced features other apps in this article had such as a debit card, investing options, and educational lessons and financial literacy games.

Cost

Bomad is Free, but there is a paid version ($2.99/month or $24.99/year for the whole family) that offers more features.

Which App Should You Choose?

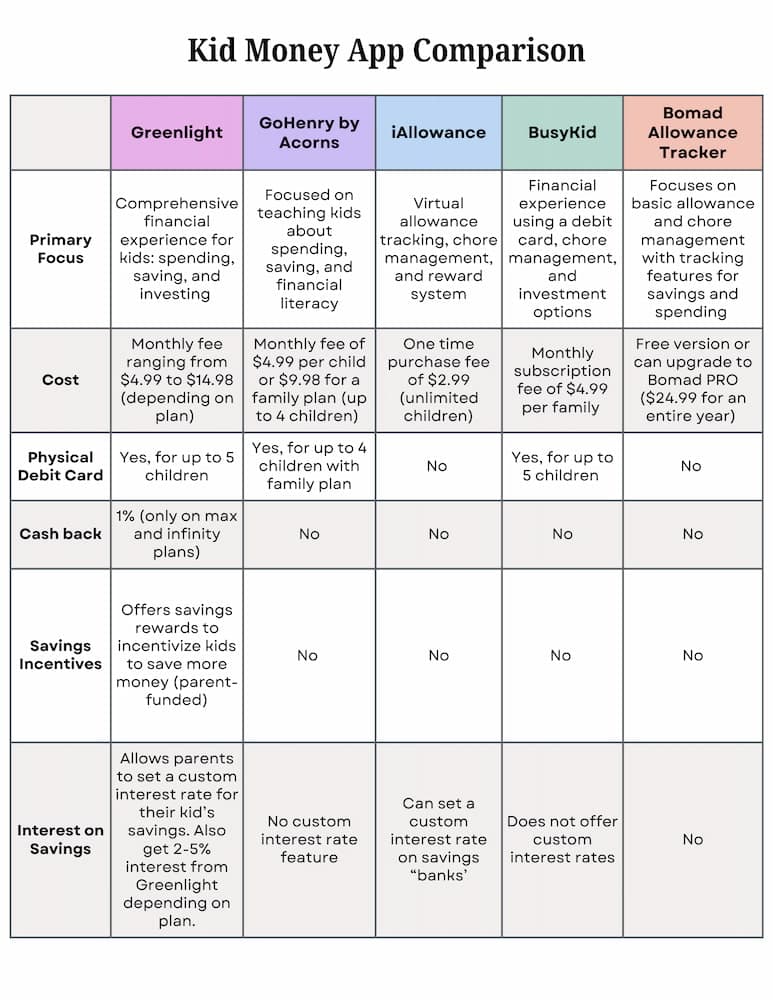

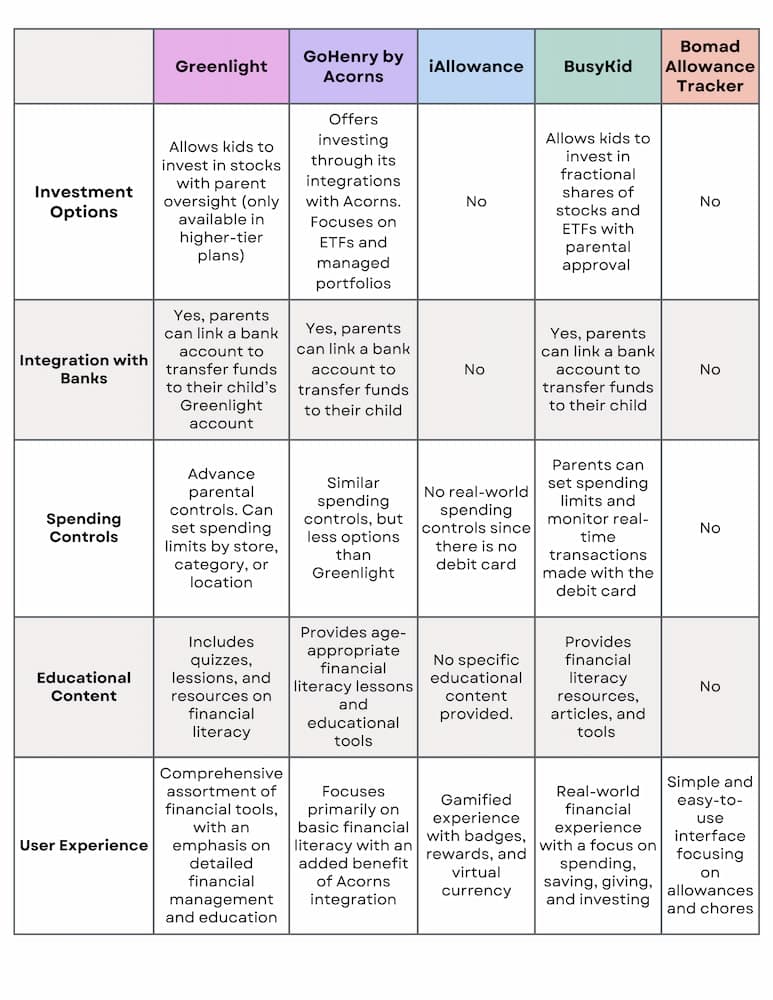

If you still aren’t sure which of the kid budgeting apps is right for your family, take a look at this comprehensive summary chart comparing and contrasting all 5 options. And get even more ideas for building money skills early by checking out this guide for toddlers and teens.